Agricultural Bank of China (ABC)

Building A Bank-Wide Graph Data Platform across Departments

Graph databases organize data using graph structures, overcoming the pain points of deep relational data analysis that are difficult to support by other databases. They provide important technological support and technical guidance for building a banking knowledge graph, enabling deep business knowledge and value discovery.

China Agricultural Bank Research and Development Center - Luo Xiaofeng

Customer Profile

Agricultural Bank of China (ABC) is a state-owned Fortune 500 commercial bank and the second largest bank in China. It maintains the largest branch network in China and offers a comprehensive range of financial services.

Business Challenges

Acceleration of transformation, high demand for data correlation analysis

Amid rapid digital transformation, the bank encountered critical challenges in big data analysis—particularly in fraud detection, customer360, and risk propagation. These tasks demanded multi-hop graph traversal and dynamic relationship analysis on large datasets, which traditional relational databases could not efficiently support.

The existing system management is decentralized, leading to high operational costs

Driven by these needs, the bank attempted to introduce graph database technologies across different departments. However, due to siloed deployment of multiple open-source graph systems with different query languages and inconsistent modeling standards, significant operational bottlenecks emerged. The absence of a unified graph platform led to high maintenance costs, inefficient resource utilization, and an inability to perform organization-wide graph-based analysis

solution

To address these pain points, Agricultural Bank of China (ABC) aimed to build a unified, standardized, enterprise-wide graph computing service system—laying a bank-level graph database technology foundation to underpin applications across all internal systems and business scenarios.

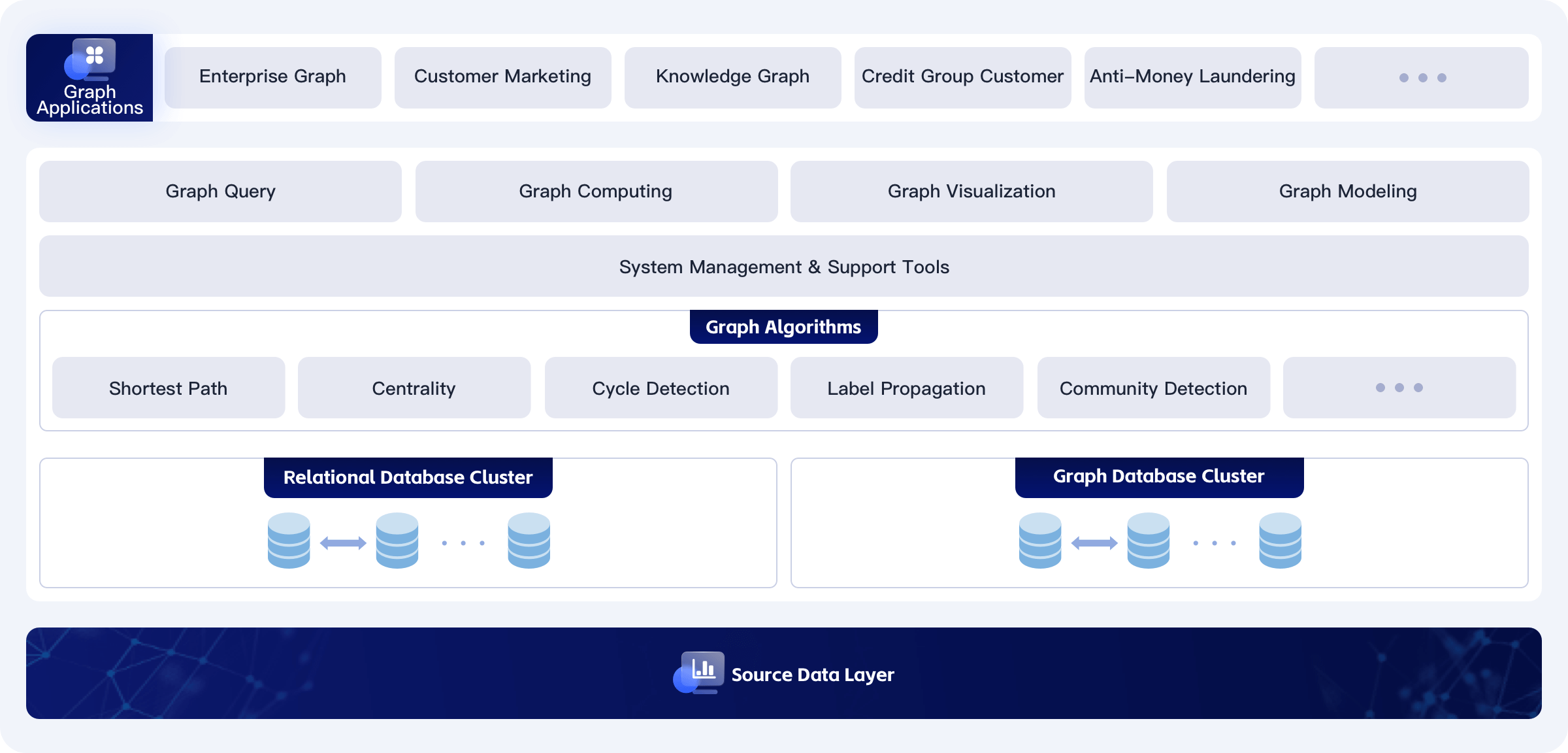

Galaxybase, as the core enabler, delivers a cloud-native Graph Database-as-a-Service (DBaaS) solution that enables centralized scheduling, on-demand allocation, unified management, and full-lifecycle monitoring of graph storage and computing resources across ABC’s business lines and user permission hierarchies. This architecture not only ensures secure and granular resource governance but also supports high-performance business querying and in-depth data mining for each business unit, fully aligning with ABC’s goal of a centralized graph technology backbone.

Graph Computing Platform Technical Architecture Diagram

Application Scenarios

The ABC has achieved significant business results in applying graph databases in areas such as credit risk control, intelligent marketing, internal audit, system O&M, knowledge graph, and many others.

Group Clients Risk Monitoring in Corporate Banking

To enhance group-wide risk surveillance, ABC implemented an integrated credit risk monitoring system. Leveraging Group Client Risk Profile and Enterprise Relationship Network Analysis, this system maps complex ownership structures and related-party transactions, enabling early detection of potential inter- and intra-group risk contagion. Leveraging Galaxybase’s graph computing capabilities, account managers can perform 10-hop equity penetration analysis with high precision to unearth hidden affiliated groups and high-risk entities. It supports consolidated limit management and connected lending risk management, which are critical for mitigating counterparty risk and preventing over-lending

Application system association analysis

ABC deployed Galaxybase to map and visualize dependency relationships among thousands of internal IT components and applications. In the event of a failure in any system module, the solution rapidly identifies potentially affected downstream systems and performs impact analysis, thereby significantly enhancing operational resilience and maintenance efficiency.

Knowledge Graph Application

Leveraging Galaxybase, ABC constructed an enterprise-scale knowledge graph platform to unify and utilize cross-departmental graph data assets. For AML compliance, the bank employed the platform to conduct risk profiling on a transaction graph encompassing 160 million entities and 370 million relationships, derived from three months of transaction records. This initiative successfully identified over 2,000 suspicious users, with a hit accuracy rate exceeding 94%, significantly enhancing the bank’s AML detection efficacy and regulatory compliance

Customer Benefits

By providing a robust and scalable graph platform, Galaxybase has not only elevated the ABC’s data processing scale and reduced operational costs but also driven commercial value by enabling innovative graph applications across departments.

Specifically, ABC’s graph data processing capacity, powered by Galaxybase, has scaled from millions of nodes/edges prior to the deployment to billions of nodes and hundreds of billions of edges—supporting both OLAP (Online Analytical Processing) for complex analytical workloads and OLTP (Online Transaction Processing) for real-time transactional scenarios. This expansion has empowered an increasing number of business units to leverage graph analytics capabilities, directly enhancing business performance across use cases like risk control and customer insight. Additionally, Galaxybase has enabled ABC to efficiently manage and schedule storage and computing resources throughout their lifecycle, optimizing resource utilization by 30%+ with notable reduction in overall O&M costs—addressing the bank’s longstanding pain points of fragmented resource governance and high operational overhead.

Create Link is the first domestic commercial graph database supplier with fully independent intellectual property rights, dedicated to providing world-class graph database products and graph intelligence services.

Business Consulting

400-882-6897

Pre-sales Consulting

0571-88013575

Enterprise Email

partner@chuanglintech.com

Media Cooperation

Marketing@chuanglintech.com

Address

Room 605, Building 6, No.666, Zhenhua Road, Sandun Town, Xihu District, Hangzhou, Zhejiang, China